Directors & Officers Insurance

Directors and officers insurance is a policy designed to offer personal liability cover for company directors, officers and managers to protect them from claims that may arise from the decisions and actions they take as part of their regular duties.

There are some common misconceptions about the cover, “It’s only for publicly traded or large companies”, “I’m never going to be in a position where I could be sued by my employees or stakeholders”, “It’s too expensive to consider”.

Here are 10 reasons why you should consider a policy

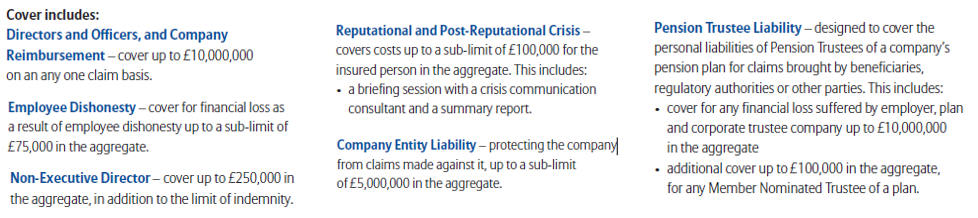

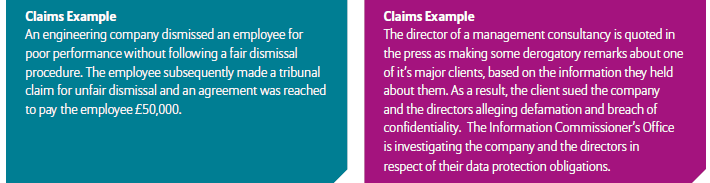

Here are some of the covers available under a directors and officers insurance policy. A full list of cover is available on request.

For a quotation or more information about this or any other business insurance product please contact Lee Masters on 01621 876030 or help@hoskininsurance.co.uk